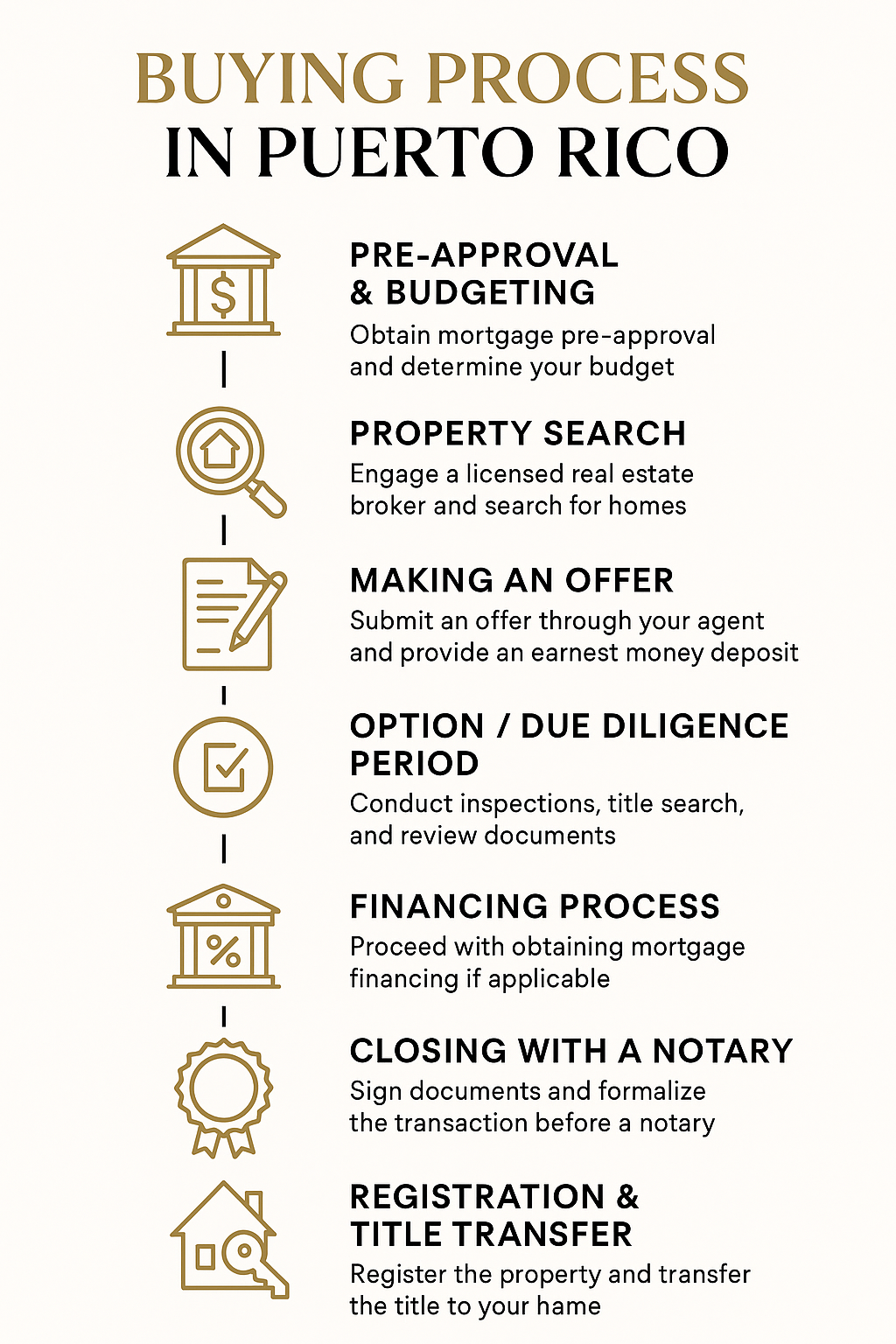

How We Help You Buy—Step by Step

Get Pre-Approved & Set Budget

We connect you with local lenders; expect closing costs around 5–7%.Search & Tour

We source options on MLS and off-market, share comps, taxes (CRIM), HOA fees, and neighborhood insights.Make an Offer

We draft terms, negotiate price/contingencies, and submit with proof of funds or pre-approval. Earnest money is typically 5–10% once accepted.Due Diligence (10–30 days)

Inspections, appraisal, title search, permit & boundary checks, HOA/condo docs—handled and tracked by our team.Finalize Financing (if applicable)

Lender orders appraisal and underwriting; we coordinate docs and milestones through clear checklists.Close with a Notary Attorney

Sign the deed (escritura) and loan docs, pay closing costs, and receive your keys.Registration & Post-Closing

The notary files the deed at the Property Registry; we guide CRIM updates, utilities, insurance, and (if eligible) homestead exemptions. Title insurance recommended.

Typical timeline: Cash 2–4 weeks • Financed 45–60 days

What you’ll need: Government ID, pre-approval or proof of funds, initial deposit, and any HOA/condo documents.